2025 AIChE Annual Meeting

(589m) Impact of Equipment Cost Estimation Model Selection on the Techno-Economic Analysis of Chemical Plants

Authors

This study investigates the variability of capital cost estimates with respect to both the level of process design detail and the choice of estimation model. Furthermore, we analyze individual equipment cost estimates across models to assess the uncertainty at the unit level. We evaluate 14 capital cost estimation models, including 7 for conceptual design1-6, 6 for practical design7-12, and 1 for detailed design. Three case studies are conducted to assess the cost models: a methanol plant based on two-stage methane reforming, an olefin plant that utilizes naphtha and methanol feedstocks, and a hydrogen liquefaction plant. These cases respectively represent processes dominated by catalytic conversion, separation, and cryogenic liquefaction.

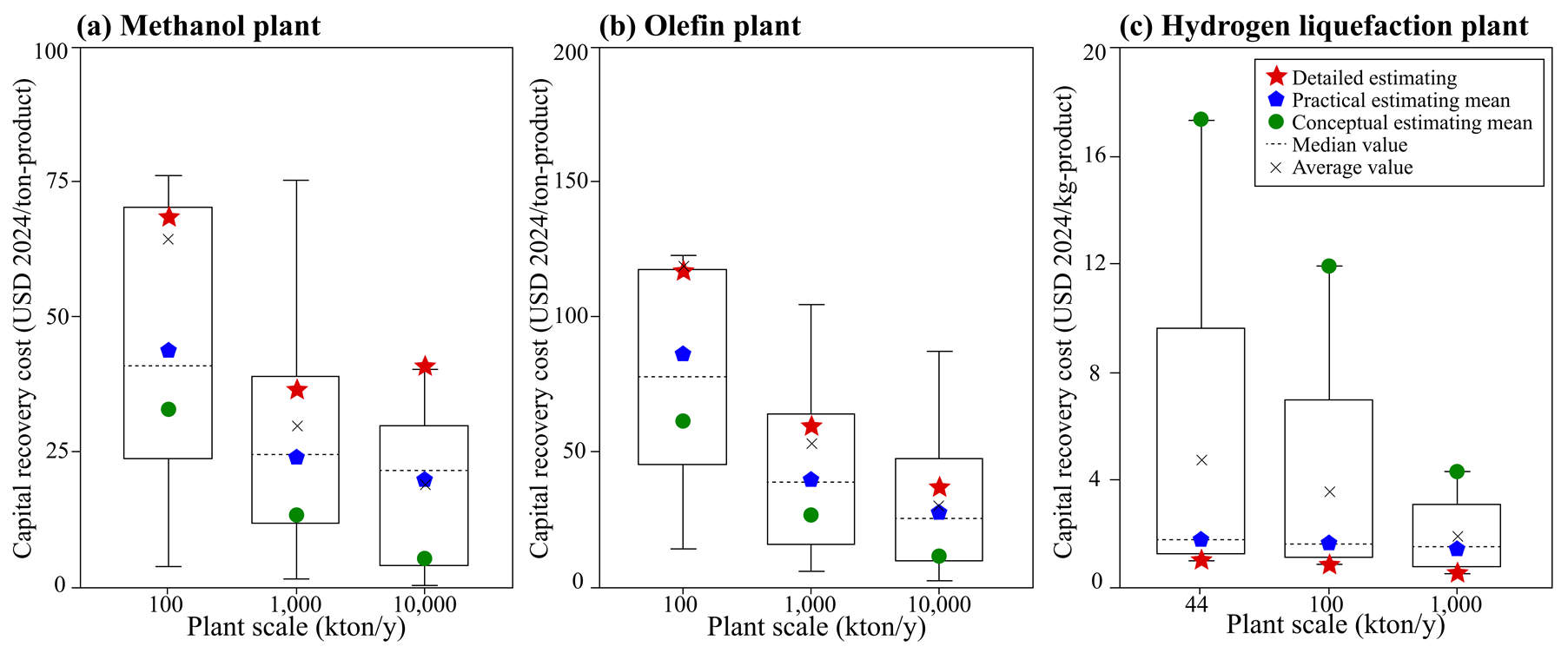

Our results reveal significant discrepancies among the estimation models (Figure 1). For methanol and olefin plants, detailed cost estimates are 56-102% and 31-51% higher than practical estimates, and 105-638% and 90-220% higher than conceptual estimates, respectively. Conversely, for hydrogen liquefaction—a process with an unconventional configuration—detailed estimates are 47-66% lower than practical estimates and 89-95% lower than conceptual estimates. Across all models, estimated capital cost variability at a medium plant scale ranges from -92.8% to +240.3% for the methanol plant, -86.1% to +168.0% for the olefin plant, and -46.0% to +656.8% for the hydrogen liquefaction plant. These findings highlight the substantial impact of both estimation model selection and process definition level on early-stage cost projections.

Reference

1. S. Peters and K.D. Timmerhaus, Plant Design and Economics for Chemical Engineers (4th ed.), New York: McGraw-Hill, 1991.

2. Garrett, D. E. (1989) Chemical Engineering Economics (Van Nostrand Reinhold).

3. Hill, R. D. (1956). What petrochemical plants cost. Petroleum Refiner, 35(8), 106-110.

4. Timms S. R. (1980). M. Phil. Thesis, Aston University.

5. Petley, Gary J. A method for estimating the capital cost of chemical process plants: fuzzy matching. Diss. Loughborough University, 1997.

6. Lange, Jean-Paul. (2001). Fuels and Chemicals Manufacturing; Guidelines for Understanding and Minimizing the Production Costs. CATTECH. 5. 82-95. 10.1023/A:1011944622328.

7. Richard A. Turton (2018), “Analysis, Synthesis, and Design of Chemical processes” (5th ed.)

8. Warren D. Seider (2016), “Product and Process Design Principles: Synthesis, Analysis and Evaluation” (4th ed.)

9. Robin Smith (2016), “Chemical Process Design and Integration” (2nd ed.)

10. Gavin Towler (2007), “Chemical Engineering Design –Principles, Practice and Economics of plant” (1st ed.)

11. S. Peters (2003), “Plant Design and Economics for Chemical Engineers” (5th ed.)

12. Lorenz T. Biegler (1997), "Systematic Methods of Chemical Process Design", (3rd ed.)

Figure 1. Range of capital recovery costs by cost estimation models: (a) methanol plant, (b) olefin plant, (c) hydrogen liquefaction plant